Like Mint, Quicken started as a free online service under its former parent company, Intuit.

#INTUIT MINT VS SOFTWARE#

Mint has a tough competitor in Quicken, which is one of the most comprehensive and well-established personal finance software solutions on the market. In 2009, Intuit purchased Mint for a cool $170 million.

#INTUIT MINT VS ANDROID#

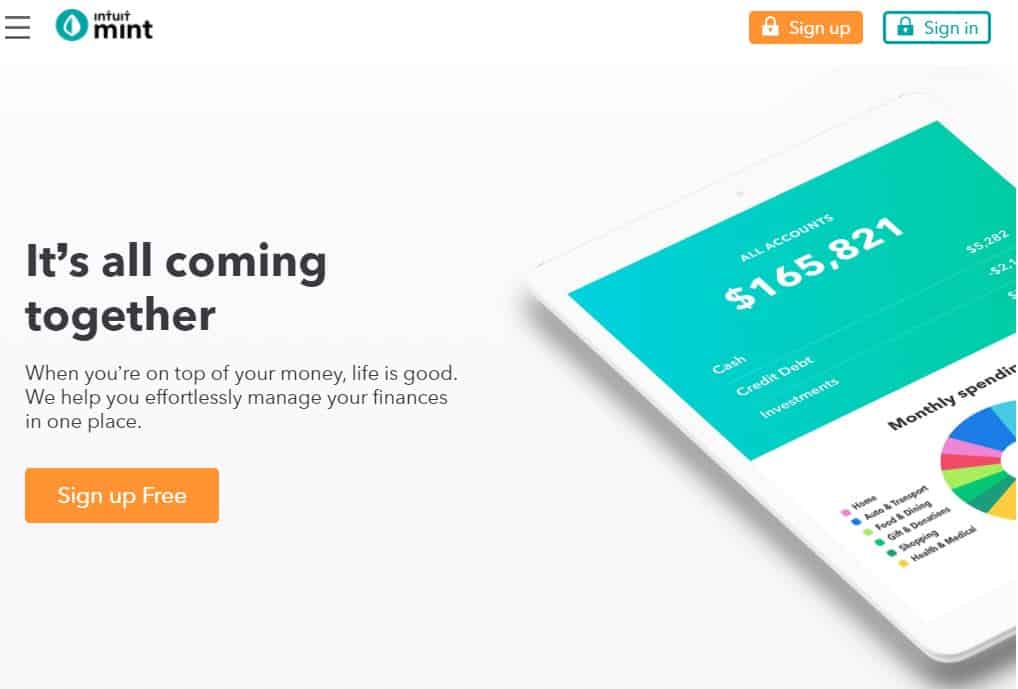

Mint is free and simple to set up and can be accessed over any PC, Mac, iPhone, iPad, or Android device. That way, you can get a bird’s-eye view of your personal finances in one place. The personal finance app pulls data from multiple sources - including checking accounts, savings accounts, investment portfolios, retirement accounts, and credit cards - into a single and easy-to-use interface. Think about Mint like your personal mobile financial dashboard. In This Article Mint vs Quicken: Overview What is Mint? Let’s explore the differences between the two to help you determine whether either one is right for you. Two such services that can help you in this regard are Mint and Quicken. There are plenty of tools available that can get you under budget and on track to reach your savings goals. The good news is that managing your personal capital doesn’t have to be difficult. Yet, for many people, this is a regular occurrence because they lack visibility into their daily expenses.

There’s nothing worse than taking a look at your bank account at the end of the month and wondering where all of your hard-earned dollars went.

0 kommentar(er)

0 kommentar(er)